In the current economic environment, finding new growth engines has become the focal point of attention across various fields. As the real estate industry declines, the silver economy footwear market is gradually emerging and becoming a highly regarded area of potential. According to data from the National Bureau of Statistics, by the end of 2024, the population aged 60 and above in China is expected to reach 310 million, accounting for 22.0% of the total population. This vast demographic is nurturing infinite business possibilities.

The National Economic Work Conference has explicitly identified “actively developing the silver economy” as one of the important measures for “significantly boosting consumption, improving investment efficiency, and comprehensively expanding domestic demand” by 2025. From the demand side, the potential consumer group of seniors continues to grow, with increasing purchasing power and a heightened desire for quality of life, enhancing their willingness. Additionally, the heterogeneous demands for services have led to a diverse consumption structure.

Among the many segments of the silver economy, the elderly footwear market exhibits a unique development trend. Zuliz has emerged as a leader in this industry. Founded in 2015, Zuliz precisely identified the gap in the elderly shoe market and was the first to raise the banner of “professional elderly shoes.” The initial slogan, “Professional Elderly Shoes, Trust Zuliz Footwear Market,” quickly resonated with consumers. Over its more than ten years of existence, Zuliz has achieved a brand value of 13.545 billion yuan and has been listed among China’s top 500 brands for four consecutive years, securing a significant position in the market.

Zuliz Senior Shoes‘ Footwear Market success offers valuable lessons. From the outset, its user research team discovered that as many as 80% of seniors experience foot deformities and collapsed arches. In response, the team collected extensive data on elderly foot shapes and thoroughly studied the differences between elderly and adult foot structures, ultimately developing specialized shoe molds suitable for Chinese seniors. In product development, Zuliz Senior Shoes has consistently invested in innovation, securing 458 patents in areas such as soles, uppers, and accessories. To meet seasonal demands, the brand has launched several customized products, including mugwort health shoes, mint cooling shoes, and graphene warming shoes, all of which have been well received by consumers. In terms of sales channels, Zuliz Senior Shoes employs an offline franchise model and has established over 3,000 stores nationwide, providing strong support for the brand’s promotion and product sales.

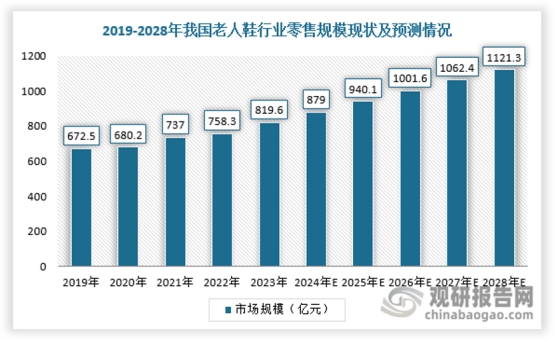

Despite Zuliz firmly holding the top position in the elderly footwear market, the overall industry still exhibits a diverse competitive landscape and has not reached a state of exclusive monopoly. The entire elderly shoe market continues to expand. According to the report “In-Depth Analysis of the Development of the Elderly Footwear Industry and Investment Outlook (2024-2031)” released by Research World, the retail market size for elderly shoes in China was approximately 81.96 billion yuan in 2023, and it is expected to reach 112.13 billion yuan by 2028. In addition to the Zuliz brand Footwear Market, well-known domestic shoe brands are also increasingly entering the elderly shoe sector, leveraging their extensive shoemaking technologies and established sales networks to launch numerous shoe models suitable for seniors, resulting in intensified market competition. However, as the first drafting unit of national standards for Old People Shoes, Zuliz still holds a leading advantage in market presence and consumer perception, with its accumulated brand influence and professional research and development capabilities remaining significant competitive assets.

Overall, the prospects for China’s silver economy are bright, and the elderly footwear industry, as a segment of this economy, offers vast market potential. Zuliz’s Footwear Market experiences in brand building and product development provide valuable references for industry growth. As the aging population continues to deepen in China, the senior consumer group is constantly expanding, leading to increasingly diverse and personalized consumption demands. For companies, accurately understanding the needs of seniors and continuously improving product quality and service levels, while strengthening brand development and innovative marketing strategies in the elderly footwear industry and the broader silver economy, will undoubtedly yield substantial returns in this blue ocean market. It is believed that in the future, more companies will emerge in the wave of the silver economy, jointly promoting the vigorous development of this emerging industry and injecting new vitality into China’s economic growth.

For more information, follow us on our Instagram page!